The first part of the $7million7year Formula For Wealth is pretty simple, therefore so is its application:

Where (W)ealth is a function of (C)apital and (T)ime

It’s pretty useful for teaching your children to save part of their allowance; other than that, you need more help than I can give you if you still don’t know that you should be investing at least some of your money (i.e. capital) 😉

But, what about a more difficult questions? Like deciding whether or not you should pay off your mortgage early?

Dave Ramsey would suggest that you pay off your mortgage NOW and INVEST (presumably, once those funds are no longer required in order to pay off your mortgage) LATER.

According to the base formula, you are still putting your money into an asset (hence, creating Capital), and allowing that to sit for a long time, which has to be a good thing, right?

Of course it’s better than spending the money – perhaps literally eating your capital (fine dining, anyone?) …

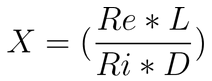

… but, is it optimal from a wealth-building perspective? For that, you need to turn to the third part of the formula – the X-Factor:

The two sub-sections of this part of the equation simply suggest that (Re)ward is offset by (Ri)sk; you have to rely on other studies (or common sense) to realize that Risk and Reward are related: as you increase Reward, so – to a greater/lesser degree, depending where you are on the Risk/Reward curve – so do you increase Risk.

In other words, Risk is a dampener for Reward – otherwise, we’d be traveling to work by jumping out of planes and playing the options market, as a matter of course!

But, the same cannot be said for (L)everage and (D)rag …

Leverage is the ‘big secret’ of building wealth: increase leverage and you MULTIPLY your wealth.

Using other people’s money is one way to increase leverage … but, by paying off your home mortgage, you are DECREASING leverage!

According to the formula, that’s bad 😉

Interestingly, Peer to Peer lending also fails the leverage test.

You see, peer to peer lending, mortgage ‘wraps’, and other products where you are financing other people, reduces your Capital and increases their Leverage … the polar opposite of what you should be doing!

So, why do banks lend money, potentially reducing their leverage?

Simple!

They’re not lending their money; they are borrowing money as well. They are leveraged to the full extent allowed by their law and their board of directors.

Which brings us back to risk:

As the banks proved before the financial crisis, applying too much leverage can be bad for your financial health.

What about risk and your home mortgage?

The argument often cited for paying down your home mortgage is one of decreasing risk. Yet, if you intend to live in the house for some extended period of time how is your risk increased / decreased by paying down debt?

How have you applied leverage to improve your wealth?

>You see, peer to peer lending, mortgage ‘wraps’, and other products where you are financing other >people, reduces your Capital and increases their Leverage … the polar opposite of what you should be >doing!

Adrian,

It seems to me that it shouldn’t matter if my investments increase someone else’s leverage or not. My leverage is determined by my total outstanding debt. The only thing that would change my leverage is lending more or paying back loans. The real trick is I doubt I can get a $100K loan at 5% with 20% down to fund peer to peer lending, but if I could I would get the same amount of leverage for a peer to peer investments as a real estate investment.

-Rick Francis

“So, why do banks lend money … Simple! They’re not lending their money … They are leveraged”

@ Rick – I agree; you become a bank. But, I still wouldn’t recommend that you invest in unsecured loans e.g. P2P

Adrian,

You just blew my mind. I’d never thought of leverage in this way — I’d been geared into an operational leverage mindset with a concern that leverage multiplies risk.

Awesome. Time to reflect… Thanks!

@ Glenn – Thanks for your comments.

BTW: leverage does multiply risk, but it also multiplies returns. Choose the level of returns that you need to get to your Number and it’s likely that you’ll be able to swallow the risk 🙂

Wealth building is quite difficult but with perserverance it is quite possible. Oftentimes, hardwork and innovation are the two things needed to succeed in business.

Your biggest obstacle to attaining wealth is YOU. Too often, people live their lives in a manner that is not conducive to creating riches and then get frustrated at “the system” when they only really have themselves to blame. ;

[link removed]