So far, this blog has covered – in a random way – perhaps 10% – 20% of what I have to offer, and over the next 2 years you can expect that to double again … so, if you can wait 4 or 5 years (and, can unscramble the order that I deliver this content in) you will know at least half of what I have to offer.

IF you can wait …

But, now I am offering another way to learn what you need to learn – quickly and in a totally ordered/guided way – AT NO COST TO YOU … NOT NOW … NEVER … EVER … really 🙂

Why?

It’s another way for me to share my ideas … and, more fuel for my next book [AJC: my first one is finished and is being hawked to publishers and agents as we speak] 😉

So, what’s this all about?

If you have been around – reading this blog – for the past two years, you will already know about my Other Site, which was host to a unique online experiment where a real multi-millionare (that would be me) offered to mentor just 7 people to make their own fortune.

Scott, Ryan, Josh, Debbie (who volunteered to leave the program to help me write a book about their experiences with this experiment), Jeff (who replaced Debbie), Diane, Mark and Lee (a retired Police Chaplan!) all participated and you can read about their experiences on that site.

Scott, Ryan, Josh, Debbie (who volunteered to leave the program to help me write a book about their experiences with this experiment), Jeff (who replaced Debbie), Diane, Mark and Lee (a retired Police Chaplan!) all participated and you can read about their experiences on that site.

If you are a regular reader of this blog, and meet a couple of very small criteria, ALL of this content is – and, will always remain – free to you!

But, I am offering you even more .. also for free / for ever …

You see, I am opening up this site to just 70 more Millionaires … in Training! and, will be offering memberships to qualified applicants for a small monthly fee … but, not for you – as a reader of this blog, I feel morally obligated (seriously!) to keep my promise that I would NEVER ask you to pay a dime for my online services.

This won’t stop me from advertising the hell out of this re-launched site elsewhere, looking for paying customers … but, NOT HERE.

[AJC: This is about as good an offer as you will ever receive in this life, so maybe you should take advantage of it]

Foundation Membership (this is exclusive for the first 70 QUALIFYING $7million7years readers) is just like the Premium Mmbership that others will need to pay for – but, you get it for LIFE and for FREE.

Joining will enable you to find:

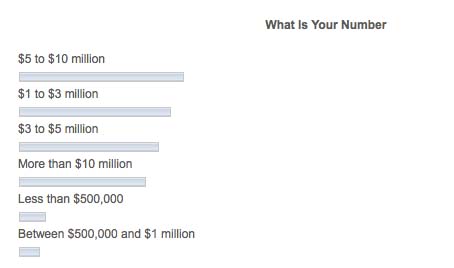

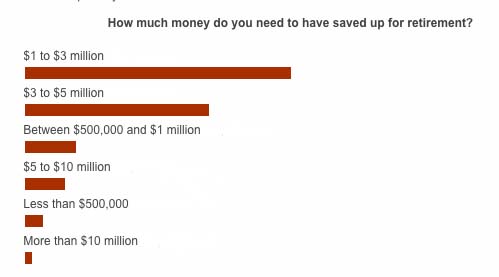

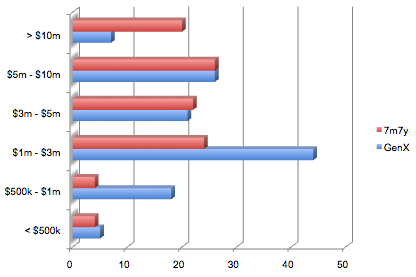

![]() EXACTLY how much money YOU need in order to be rich [hint: this will be different for everybody]

EXACTLY how much money YOU need in order to be rich [hint: this will be different for everybody]

![]() WHEN you need to stop working full-time and WHAT you will be doing with your new-found freedom

WHEN you need to stop working full-time and WHAT you will be doing with your new-found freedom

![]() WHAT steps you need to take in order to amass the fortune that you need

WHAT steps you need to take in order to amass the fortune that you need

![]() HOW to find your passion and turn that into cash

HOW to find your passion and turn that into cash

Most importantly, you will find THE ONE THING – more than any other – that helped me move from $30k in debt to $7 million in the bank in just 7 years … and, how it is virtually guaranteed to work for you.

This is no scam or Get Rich Quick system that tells you how to invest in real-estate, stocks, online businesses, or any other method that made the author rich [or, was it just selling you the information that made the author rich?!] …

… no, this is a NEW and UNIQUE Guided Learning Experience that will show you how to get as rich as you need to be, doing whatever it is that you are most passionate about.

Haven’t found your passion?

Don’t worry, that’s one of the first things that we will cover 😉

If you want to become one of the 70 Millionaires … In Training! click here now, before 70 others jump in ahead of you!

Still reading?

There’s nothing more to know!

Just click the button … I’m offering you – just 70 of you – the Keys To Willy Wonka’s Chocolate Factory, perhaps you shouldn’t look a gift horse in the mouth? 🙂

Good Luck!

Adrian.