There’s a Rule of Thumb that says that you should keep 100% – Your Current Age in stocks (and, the rest in bonds).

There’s a Rule of Thumb that says that you should keep 100% – Your Current Age in stocks (and, the rest in bonds).

For example, if you are currently 27 years old, you should keep 27% of your current investments in bonds and the remainder (73%) in stocks e.g. an Index Fund that mirrors the S&P500.

There’s also a new school of thought that says the numbers should be ‘upped’ to 110% or even 120%, to ensure that you keep a larger percentage of your net worth in stocks at a young age, whilst you can still stand the volatility of the stock market (c’mon, you haven’t forgotten 2008 already?) and allow for a larger upside to help find your longer lifespan.

But, there’s a problem:

Let’s say that you want to retire at age 65, and you are currently 60; the original ‘rule’ says that you should still have 40% of your (hopefully, now considerable) net worth in stocks; the question is:

If you plan to retire in 5 years, what % of your net worth should you put in stocks?

Well, the answer is none.

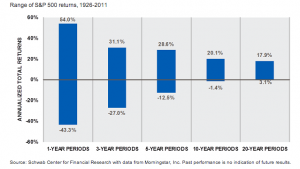

5 years is too short an investment horizon to invest in stocks!

In fact, we’ve already established that the best place to keep your savings is in CD’s:

Over 5 years, based on past performance, there’s simply too much chance that you will lose money on the stock portion of your portfolio.

But, that’s not the major problem that I have with this – or any – theory of asset allocation …

… my issue is that asset allocation theory only works in long timeframes (again, because we can’t afford risk of loss), say > 10 years, and probably greater than 20.

And 10 to 20 years didn’t work for me, because my plan was to make $7 million in 7 years.

To have any hope of emulating my outcome, you need to focus on three things:

1. Building up the largest ‘starting bank’ that you can,

2. Not spending more than you absolutely have to help build that starting capital in the shortest space of time possible, and

3. (this is the most critical of the three), investing to obtain the highest possible compound growth rate.

Sitting on a basket of stocks and bonds – no matter what the mix – probably won’t cut it.

Short time frames put a LOT of pressure on modern asset allocation and portfolio theories …

… way too much pressure, if you ask me.

At this point (I’m 30), all my investments are in stocks. I figure I’ll start shifting away in the next 20 years or so.

@ Elizabeth – Warren Buffett would agree that you should keep all your eggs in one basket …

… but, it has to be the RIGHT basket and you should WATCH it carefully!

@Adrian.

If you follow Rule # 1 investing, I think the stock market can be your friend at any age, just wait for the right wave before surfing….

“But, there’s a problem:

Let’s say that you want to retire at age 65, and you are currently 60; the original ‘rule’ says that you should still have 40% of your (hopefully, now considerable) net worth in stocks; the question is:

If you plan to retire in 5 years, what % of your net worth should you put in stocks?

Well, the answer is none.”

Unfortunately, I must point out that your logic is faulty here Adrian. The assumption you are making is that you need 100% of your money the day you retire, which is not correct. Your investment time horizon remains quite long still, even if you retire at 65.

The average person in the demographic reading your blog is going to live to 85-90 years old! Planning for the shortest lived of us yields an additional 20 years of investing ahead of us!

That being said, you still have to maintain a reasonable asset allocation (the golden rule you quoted above would indicate 35% in equities/65% in fixed which I would still agree with) to ensure ongoing ROI that outpaces inflation, or even continues to grow!

@ Dustin – Good pickup. But, my logic is correct, because on the day that you retire you must totally shift strategies … stay tuned! 😉

Loving the website Adrian!

Quick question – Can you please elaborate on point 1:

1. Building up the largest ‘starting bank’ that you can.

Save 10% of your income, first to pay off expensive (eg credit card) debt, then to bankroll your first business or real investments.