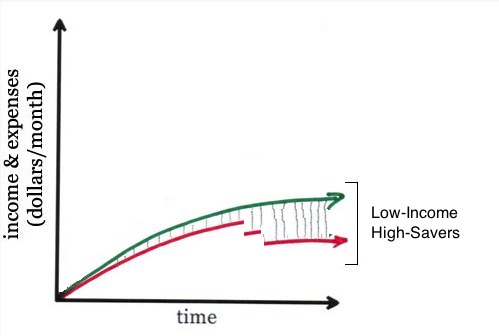

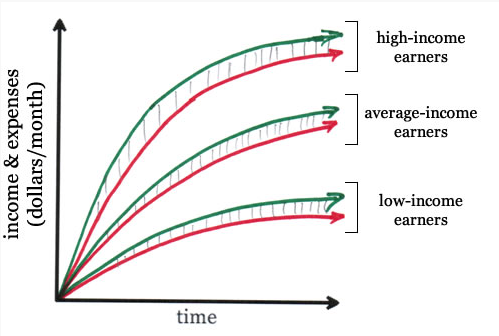

Fellow blogger, Jonathan Ping, was kind enough to include a chart from one of my earlier posts in one of his recent posts, so I thought that I should repay the favor by including one of his charts, here:

I recommend that you read his original post, but the chart itself is pretty self-explanatory; it shows the problem in personal finance … and that’s:

As your income grows so do your expenses.

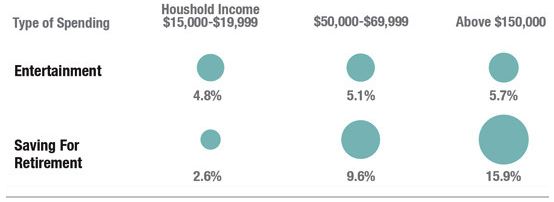

It’s called ‘lifestyle creep’ and is one of the key reasons why the actual wealth of high-income earners (as indicated by the grey shading between the green income line and the red expense line) is not necessarily that much higher than that of some medium- (or even low-) income earners.

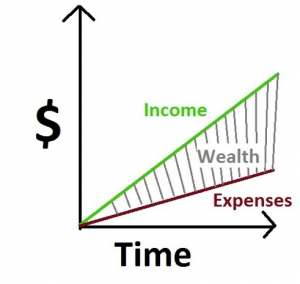

The obvious solution, according to Joe and many other pf bloggers, is to reduce your spending:

This way, you decrease the red expense line relative to the green income line …

… in the process, enlarging the grey-shaded area between the two lines i.e. allowing, at least in theory, even low-income earners to increase their wealth!

The problem with this strategy is that saving – especially, saving more (probably a lot more) than you do now – is really, really, really hard.

Austerity hurts. Austerity is against nature (well, my nature).

It gets worse: saving now so that you can spend later simply doesn’t work!

To make this type of cookie cutter personal finance plan actually work, you need to be debt-free and be able to live on just half your current annual income for your whole life.

In other words, you need to drop the red savings line to no more than half the green income line … not later, but now … and keep it there for the rest of your life.

Never fear, I have a better plan …

… it’s one that is far more natural, because it allows you to maintain your current standard of living, even increase it over time:

Let’s say that you start off as an average-income earner; here are your steps to success:

1. You can start to save a little, perhaps more than you have done in the past. Don’t worry, this austerity is temporary … after all, you already know how I feel about too much belt-tightening.

2. Once you have a little money beginning to pile up, you should find a way to put it to use to help you grow your income. Perhaps you could: start a part-time business; buy an ‘absentee-owner’ franchise; or open a car wash. You could work a little smarter and score that big (or little) promotion. Maybe you could collect a windfall: a tax refund; find a rich aunt who dies and decides not to leave all her money to her cat after all; or, you get really lucky and hit a small jackpot at Binions.

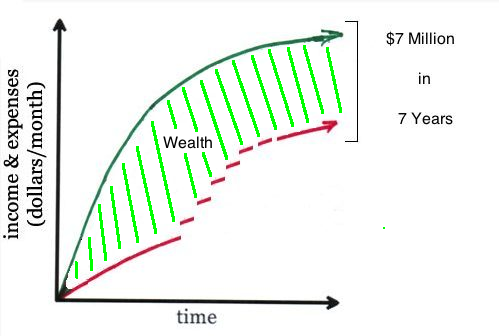

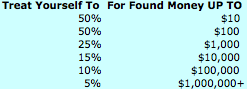

3. As your income grows, you should increase your spending by no more than 50% of your after-tax ‘pay rise’. The rest must go back into your little pile of money. Then you should concentrate on finding even more ways to put it to use to help you grow your income. Are you beginning to see a pattern here?

4. As your income grows at a (much) faster rate than your spending, you will slowly begin to see that you are actually already tending towards saving 50% of your income without even trying!

Keep it up for 15 to 20 years, and you’ll be able to sustain that savings rate all the way through – and beyond – retirement, as you build a big enough bucket of wealth (your net worth) as shown by the green-shaded area between your income and expense lines.

What’s more, this fully sustainable standard of living is always more than your current standard of living, so you never, ever need to tighten your best. The secret with this plan is that you simply don’t loosen your belt as fast as other high-income earners tend to do.

Obvious, really …

Now, that’s what I call eco-friendly finance 😉

[You can also read this post in the Carnival of Personal Finance: http://wealthpilgrim.com/