A couple of weeks ago I wrote about the dismal financial track record of professional athletes:

A couple of weeks ago I wrote about the dismal financial track record of professional athletes:

78% of NFL players and 60% of NBA players are bankrupt within two years of leaving the game.

Before you jump to the stereotypical conclusion that sports people have had one too many hits to the head, realize that the IQ of professional athletes is no better or worse than yours or mine:

The l.Q. of superior athletes ranges on average from 96 to 107

That’s why I think the reason is simple and generic: anybody who gets money quickly loses it almost as quickly.

To prove my point, look at the financial longevity of lottery winners, who should represent a fair cross-section of society [AJC: setting aside that you must have a low IQ to want to enter the lottery]:

More than 1,900 winners of a Florida lottery who won between $50,000 and $150,000 went bankrupt within five years.

So, if making money too quickly is a sure indicator of later financial disaster, what do you do? Refuse the money?

Not likely!

But, the one advantage that pro-athletes have over the rest of the pupulation is their ability to follow a playbook …

… so, here is the $7 million 7 years playbook for dealing with Found Money (i.e. any large amount of money that suddenly falls into your lap):

If you’re lucky enough to receive such a windfall (e.g. win the lottery; land a professional sports contract; star in a major motion picture; get acquired by Google; etc.), you should spend enough to fully celebrate your good fortune (even more so if it was a result of hard work rather than luck).

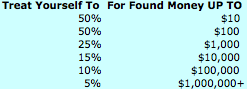

But, the amount you spend should be a reflection of how much Found Money you have, up to a maximum of 50% of the amount that landed in your lap. For example:

– If you find $20 on the street, buy yourself a latte and a magazine and then put the other $10 in your end-of-month savings ‘cookie jar’

– If you sell your business for $2 Million don’t spend $1 million

– If you get a $200 a week pay increase:

… do spend $100 immediately (enjoy!)

… don’t spend $100 extra a week (unless you HAVE to)

Here’s a table that will help you decide how much to save and how much to spend, depending on how much Found Money you suddenly come across:

If you find yourself toward the high end of this table (e.g spending $1,000 or more), spend it on something – or, some things – that you will remember for a long time.

Oh, and if you’re not a professional athlete … well, you can still follow a playbook as simple as this one, can’t you?

Don’t give handouts to friends and family who suddenly have this urge to be by your side all the time and tell you everything you want to hear. That’s another big one!

@ Money Beagle – Awesome! BTW: can I borrow $50?

I think we need to be teaching financial skills from a young age, and continue teaching these skills throughout the education process. That would make a huge dent in these professional athletes being so dumb with their money.

“That would make a huge dent in these professional athletes being so dumb with their money.”

@ Mike – I agree, with the ‘early education’ idea, although I would substitute the words “seemingly lucky people who have a large sum of money suddenly fall into their lap” for “professional athletes”.

Pingback: How to retire in 7 years …- 7million7years