I’ve packed my rod’n’reel and I’m travelin’ for the next couple’a weeks …. be back soon, y’all y’hear?!

Monthly Archives: June 2010

The Zero Dollar Emergency Fund!

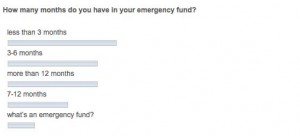

Last week I asked How many months do you have in your emergency fund?

Earlier, my blogging friend JD Roth at get Rich Slowly (GRS) asked the same question of his readers, and this is what he found:

| How many months do you have in your emergency fund? | ||

|---|---|---|

| GRS | 7m7y | |

| less than 3 months | 38% | 29% |

| 3-6 months | 26% | 24% |

| 7-12 months | 13% | 24% |

| more than 12 months | 14% | 16% |

This shows that more 7m7y readers have 3+ months living expenses in their ’emergency funds’ than GRS readers, which means …

… I’ve done a terrible job 🙁

On the other hand, if you answered “what’s an emergency fund?” good for you, you’re already a step ahead of the pack … you see, not everybody – including me – thinks that you need to have an emergency fund at all!

[AJC: At least not until after you reach Your Number]

For instance, Liz Pulliam Weston writes at MSN Money that you should have a $0 emergency fund, replacing it with a concept that she calls ‘financial flexibility’:

The whole idea that everyone needs a big pile of cash, and needs it right now, should be rethought. In reality, the failure to have a fat emergency fund isn’t inevitably a crisis. At the same time, those who feel safe because they have three or even six months’ expenses saved up might be kidding themselves.

Let’s say your take-home pay is about $4,000 a month. Although you have been spending every dime, you make a concerted effort to trim your expenses by 10%. This not only frees up money for your emergency savings but lowers the total amount you need to save from $12,000 to $10,800.

Still, it will take you 27 months — more than two years — to scrape together your emergency fund. And that assumes nothing comes up that forces you to raid your cache.

Let’s explore this a litter further: JD Roth has $10,000 in his emergency fund, but that doesn’t just represent $10,000 today …

…. it represents the future value of $10,000:

Let’s say that you intend to retire in 20 years, if you earn 9% on your money (say, invested in Index Funds) then you are giving up, say, 2% bank interest (by having your emergency fund sit in an ordinary savings account for quick ’emergency’ access) to earn 9% – or, a net of 7%.

That extra 7% earned represents about $8k in extra interest/profit that you are giving up for the benefit of ‘peace of mind’ in an emergency. But, we aren’t investing our money in Index Funds, because we are on a mission: we want to reach $7 Million in just 7 Years!

To us – that is, those of us on a steep financial trajectory – this $10k pile of cash represents seed capital for your new business venture or next real-estate acquisition [AJC: and, don’t tell me that an extra $10k wouldn’t be a big help for either of these endeavors] …

… now, $10k ‘invested’ at:

- 15% (stocks) grows to $35,000 after just 10 years

- 30% (real-estate) grows to $106,000 after just 10 years

- 50% (business) grows to $384,000 after just 10 years

… a slightly larger price to pay for peace of mind 🙂

Who wants to be a billionaire?

Do you want $1 Billion? If so, I can’t help you much, but maybe this video can help …

For the rest of us, what will YOU spend your money on when your reach YOUR Number (list in the comments)? Even if it is only a paltry $7 Million in 7 years 🙂

To get you started, here’s my list:

House ($6 million; later ‘downsize’ to apartment worth ‘only’ $2 million)

Cars ($500k + $50k p.a. towards buying newer ones every few years)

Travel x 2 to 4 trips per year ($50k p.a.)

Startups ($500k) – Maybe these will pay off, maybe not 😉

Speaking Tours (incl. in travel + $25k marketing budget) – as above!

Charitable Donations (at least $25k p.a.) + time: my wife’s 🙂

… then, there’s all the ‘living’ type stuff: house/parties/clothes/restaurants/sports/etc./etc. ($200k p.a.)

How about you?

… but, Will Smith isn’t (completely) happy

So, the jury is IN: money does buy (at least some) happiness …

So, the jury is IN: money does buy (at least some) happiness …

… then, why isn’t Will Smith (who has PLENTY of money) completely happy?!

First, let me backtrack a little:

One of the advantages of being rich – well, 7m7y kind of ‘rich’ – is that acquiring technology isn’t an issue.

That’s why we have a Slingbox, which sends live streaming video from our friend’s satellite TV in Atlanta right to my wife’s PC (or, our home theater) in Australia.

This means that she doesn’t need to miss out on the most current episode of Oprah, and neither do I … on the odd occasion that I happen to be in the same room when she’s watching.

As it happened, on this occasion my wife was catching up on some more recent episodes that she missed while we were busy moving house, and it was how I happened to catch a bit of Will Smith’s Oprah interview.

Will said a couple of things that intrigued me:

First, he said that no matter how much money he accumulates, he never stops worrying about money!

Well, that’s actually good news, because I can see that through every stage of my financial journey, I have never stopped worrying about money.

Good news, because if Will Smith – who must be an order of magnitude or two ahead of me, financially speaking – worries about money, then I can stop worrying about worrying about money.

And, so should you!

It appears that worrying about money is a normal part of the human condition 🙂

The second thing that Will said interested me even more: he’s not satisfied with his achievements to date … he can’t believe that he was put on earth merely to entertain people.

It seems that Will hasn’t found his Life’s Purpose!

Confirmation, to me, that fulfilment comes in three parts:

1. Discovering your Life’s Purpose, then

2. Working towards it, using whatever tools/talents you have been given, then

3. Finally, living your Life’s Purpose.

Step 2 is a means to an end (and, there’s no reason why you can’t bypass it if your Life’s Purpose doesn’t require the passing of time, or the accumulation of supporting assets).

But, don’t confuse Step 2. with Step 3. …

… Will Smith might be famous and known for his singing/acting talents, but (for him) it appears they are merely a means to an end.

Discover your ‘end’, and the ‘means’ – even if not as exciting, profitable, and/or high-profile as Will Smith’s – becomes much more palatable.

What do you think?

I’ve received an award!

I’m not sure who Awarding the Web are, but they have kindly just listed $7million7years as one of their ‘Top 40″ Business Blogs in the “Saving Money” category.

This is kind of ironic as I am keeping company with the likes of Frugal For Life, Bargain Briana, Bitter Wallet, and FruGal [AJC: I love puns … unfortunately for those around me, the more groan-inducing, the better] …

… but, this blog is about as un-saving money as you can get (!):

http://7million7years.com/2009/05/02/save-your-way-to-wealth/

Yet, we do spend a lot of time in Making Money 101 on saving tips:

The reason: habit.

While I stick to my guns and say that you can’t save your way to any reasonably large Number by any reasonably soon Date [AJC: Pick any Number north of $1 million, and any Date south of 15 years and see what you come up with, inflation adjusted], the reason why you should still save/save/save is twofold:

1. You create the seed capital that you might need for your first real-estate purchase and/or business venture … it’s these that will create your Number/Date, and

2. You create the habits that will stop you from spending your wealth once you get it.

Saving money is kind’a like the bookends to your financial life …

… but, true wealth building is in the bits you do in between that really have nothing at all to do with saving.

Well, not directly 😉

Money does buy happiness …

I have become obsessed with lotteries!

Not in participating … I don’t: I recently refused to buy a $7 ticket to a $20 million+ lottery; the vendor thought that I was crazy, but he was crazy.

[AJC: Actually, I used to participate in my office lottery syndicate as a form of ‘insurance’: if my staff won, they might leave en masse, at least my lottery winning would help cushion the blow … this is really how I think!]

There are government-sponsored anti-gambling ads running on Australian television right now that show that you have around twenty times the chance of a number one record as you do to win the biggest jackpot on a slot machine … lotteries are worse, much worse.

Yet, I can understand the temptation because the prizes are so large.

My interest actually has to do with my ‘easy come, easy go’ thesis: I believe that in order to keep a large sum of money, you have to make it slowly (so that you can learn the necessary financial lessons along the way) … by slowly, I mean years – say, 7 – not days.

When I heard that 80% of lottery winners lose their winnings within 5 years, I became very interested to find out more. Unfortunately, stats are hard to find:

Nora Moon, validations supervisor with the Virginia Lottery, has dealt with almost every lottery winner since the lottery began. Estimating how many Lotto winners have gotten into financial trouble is impossible, she said.

Documents submitted to the Supreme Court of Texas by the Attorney General state:

Steve Danish, a Virginia Commonwealth University psychology professor who has counseled Virginia Lottery winners, said one-third of about 40 winners he talked to in a seminar several years ago asked questions indicating they were in financial trouble.

But, I think the most interesting source comes from the lottery itself: Camelot Group Plc, who is the operator of The UK National Lottery. Camelot commissioned Ipsos MORI (a leading UK research house); in a good news / bad news survey, they found:

More than half the Lottery winners are happier now than they were before their win (55%). Most of the other winners claim that winning the Lottery has not affected their level of happiness, largely due to the fact that they were happy before their win. Only 2% of winners were less happy. The happiness of the winner is not affected by the size of his or her win.

Of the winners who are happier (55%) around two thirds claim one of the reasons is improved financial security and fewer worries (65%). A further 23% either stated that they can buy what they want now or that life is generally a lot easier.

The large majority of Lottery winners have not experienced any negative effects on family life or friendships.

That’s the good news … surprisingly (after all, the research was sponsored by the operators of the lottery!), there was some terribly bad news in a one-liner buried in the body of the report; money does buy happiness … but, that money (and, presumably, the happiness) is short-lived:

On average, the winners have so far spent 44% of their winnings …

Whoa!

I forgot to mention that this survey carried out in 1999 by MORI, marked the 5th birthday of The National Lottery and the findings “represent the most complete snapshot of the generation of Lottery winners who have emerged since the first draw on 19 November 1994”.

That’s a 44% depletion of winnings during a 5 year period or, on average, after just 2.5 years!

All of a sudden the ‘80% of lottery winners are broke after 5 years’ myth is not so ‘mythical’ after all; here’s the lottery winner’s life cycle:

Happy => Rich => Happy => Spend => Broke => Happy or Devastated … you decide?

In either case, my ‘easy come, easy go’ thesis is looking better all the time 🙁

What’s better: a satisified mind or money?

Sadly, not too long (less than 5 years) after this performance of the great Red Hayes song (covered by everybody from Johnny Cash to Bob Dylan, and even The Byrds), Jeff Buckley died; that makes TWO great reasons to find your Life’s Purpose … the other being in the opening lyrics to this great song:

How many times have you heard someone say: “If I had money, I would do things my way.”

But little they know, that it’s so hard to find one rich man in ten, with a satisfied mind.

Money can’t buy back all your youth when you’re old, a friend when you’re lonely, or peace to your soul.

The wealthiest person, is a pauper at times compared to the man with a satisfied mind.

Find your Life’s Purpose, then the money will mean something: Your Number will be the financial enabler of Your Life’s Purpose!

After all, there’s no other good reason to be wealthy, is there?

The much maligned Robert Kiyosaki

Robert Kiyosaki is famous (or infamous, depending on your viewpoint) for his break-out book: Rich Dad, Poor Dad.

Robert Kiyosaki is famous (or infamous, depending on your viewpoint) for his break-out book: Rich Dad, Poor Dad.

Whichever way you happen to lean on this subject (and, please feel free to share!), I think that he deserves to be congratulated for thrusting personal finance back into the spotlight, and he equally deserves to be admired for his ability to parlay that first success into a personal finance publishing empire that includes 10 to 20 books, a few games, and so on.

In fact, RDPD is one of the very first books on personal finance that I ever read, and is certainly the book that inspired me to look into the field very deeply.

It’s unfortunate, then, that Robert Kiyosaki has managed to build up both a cult following and a cult anti-following (?!), neither of which I ascribe to.

Jake says, somewhat, tongue in cheek:

Ahh, so you will now renounce your belief that Kiyosaki is not a quack?

Abandon the dark side…

Actually, Jake, I’ve never commented on RK’s quackiness of lack thereof 😛

All I’ve said is:

1. His book – at the time – inspired me to look into the field of personal finance a LOT further.

2. I like RK’s definition of liability v asset (albeit, not technically correct, he says an ‘asset puts money in your pocket, and a liability takes money out’. Neat!).

3. I think that RK became rich because of his book, and was worth ‘only’ circa $1.5 mill. (give or take $500k) before.

I base this last assessment purely on a statement he made in RDPD (or one of his later books, perhaps Cashflow Quadrant? … I’m working from memory, here, as I have filed his book away somewhere) that he ‘retired’ to write that first book (or was it to create his board game?) on passive income of $100k p.a., driven primarily by real-estate.

That’s pretty much it!

But, and this is important, realizing that a lot of these personal finance gurus – whether well-meaning and genuine in their belief or out-and-out scammers, scoundrels, and liars – actually made their real wealth, if at all, AFTER (or because) they wrote their books …

… I firmly resolved that I would study the field of personal finance, apply what I learned, and (hopefully!) become rich in the process, THEN write about it from the standpoint of a REAL self-made, multi-millionaire entrepreneur and investor.

This blog is the result 🙂

Where does the money go?

If it takes an average of just 2-and-a-half years for UK lottery winners to blow 44% of their winnings, where does the money go?

If it takes an average of just 2-and-a-half years for UK lottery winners to blow 44% of their winnings, where does the money go?

Well, Camelot (the operators of the UK lottery) commissioned a follow-up report in 2002:

A third of winners (34%) buy a car straightaway, while one in 10 (11%) buy new clothes or new jewelery. For around four in five (77%) the most expensive single purchase is a house, followed by a car (14%). A quarter of winners give up to 10% of their winnings to their family, while nearly a half more (45%) give family eleven to thirty percent. Almost three in five give up to 10% to friends, while two thirds give up to 10% to charity.

Why do these winners figuratively throw their money out the window?

I think I’ve stumbled on a clue; they think that they can just win it all back again:

As to doing the Lotto, four in five jackpot winners (82%) still play every week — and one in five (21%) is very confident of winning again.

And, I think that in here is a very important lesson for those of you lucky enough to become successful with your Making Money 201 (Wealth Acceleration) activities:

Don’t spend your money as though you can just keep on making it all over again … you take on huge (hopefully, calculated) risks to reach your Number by your Date.

But, once you get there, switch to Making Money 301 (Protecting Your Wealth) because you just may not be so lucky the next time around 😉

5 Secrets Of Self-Made Millionaires

I’m a voracious reader of anything that purports to teach you how to be rich … when I needed to learn, I read everything hoping to find ‘the answer’ … and, after I made it, I continued reading (but, I must admit that I am more discerning now) mostly out of curiosity (to see what others are saying).

In both cases, I was almost invariably disappointed … hence this blog.

But, I was pleasantly surprised to read an article with a [groan] headline: 5 Secrets of Self-Made Millionaires …

… it’s actually not that bad. Not rocket-science, but not anywhere near as bad as most similar articles and books are.

Here are the 5 ‘secrets’ and my take on each:

1. Set your sights on where you’re going

T. Harv Eker, author of Secrets of the Millionaire Mind [another groan] says:

The biggest obstacle to wealth is fear. People are afraid to think big, but if you think small, you’ll only achieve small things.

Wanting to be wealthy is a crucial first step.

I obviously agree; if you don’t understand why, you must be a new reader [Hint: It’s to do with discovering your Life’s Purpose and Your Number / Date]

2. Educate yourself

You’re reading this blog post … and, I wrote it, didn’t I? ‘Nuff said 🙂

3. Passion pays off

See 1. above … ZZZZZzzzzzzzzzz

4. Grow your money

Well, d’uh!

But, Loral Langemeier, author of The Millionaire Maker, adds something sensible:

The fastest way to get out of that pattern [the never-ending cycle of living paycheck to paycheck] is to make extra money for the specific purpose of reinvesting in yourself.

[AJC: I would delete the last two words, which are hokum; it doesn’t cost much to “reinvest in yourself” except time … for example, this blog is FREE].

I like this part [AJC: I bolded the part that I like the best … I like it, because I did it, too; that’s how I raised the capital to expand to the USA i.e. from profits left in the business]:

A little moonlighting cash really can grow into a million. Twenty-five years ago, Rick Sikorski dreamed of owning a personal training business. “I rented a tiny studio where I charged $15 an hour,” he says. When money started trickling in, he squirreled it away instead of spending it, putting it all back into the business. Rick’s 400-square-foot studio is now Fitness Together, a franchise based in Highlands Ranch, Colorado, with more than 360 locations worldwide. And he’s worth over $40 million.

I also like:

If you want to get rich, you need to pay yourself first, by putting money where it will work hard for you—whether that’s in your retirement fund, a side business or investments like real estate.

5. No guts, no glory

If there’s any one secret in all of this, it’s this one:

Iif you are a timid mouse (like me), you either have to learn to roar (like I had to) or learn to live with a Small Number / Never Date.

Getting the Life’s Purpose ‘religion’ is one way to put the fire in your belly … it worked for me.

Oh, and they leave the best secret to last (at least the author feels it’s the best), which is funny because this would then be Secret # 6:

The Biggest Secret? Stop spending.

I agree with everything AFTER the ‘?’ above 😉

If you don’t have the money to invest, don’t spend … it’s simple!

But, I don’t agree with this:

Every millionaire we spoke to has one thing in common: Not a single one spends needlessly. Real estate investor Dave Lindahl drives a Ford Explorer and says his middle-class neighbors would be shocked to learn how much he’s worth. Fitness mogul Rick Sikorski can’t fathom why anyone would buy bottled water. Steve Maxwell, the finance teacher, looked at a $1.5 million home but decided to buy one for half the price because “a house with double the cost wouldn’t give me double the enjoyment.”

Don’t believe that Millionaire Next Door cr*p; some multi-millionaires are frugal – even some Billionaires (most notably Warren Buffett) – but, don’t be fooled into believing that’s the majority of multi-millionaires:

I have a friend who works for a 35 year old Russian immigrant who is now a hugely successful hedge fund manager (yes, he’s survived the GFC as far as I know. I’ll check when I’m on Safari in South Africa with my friend later on this year); my friend overheard him explaining to his daughter that he was going to take the family jet to a business meeting, so she would need to fly on a commercial airliner with her mother to get home from their vacation.

This is what he said to his daughter: “You know that there will be people you don’t know on that plane” … at 8 years old, she had never flown other than by private jet!

Another friend works in MLM and had breakfast with that company’s # 1 distributor – a nice, young lady. She receives a $600,000 check every month. She just bought a mountain in Colorado and a special tractor, so that she could grade her own private ski run.

I hope she puts a lot aside for a rainy day; gives overly generously (money and time) to charity and those in need; and, joyfully spends the rest!

I have a simple rule: spend freely, when it doesn’t make sense not to.

Think about that, and let me know what you think it means …