Oops, I made a couple of mistakes, and one of the millionaire ‘success factors’ that I believe in is to admit your mistakes, make restitution as best you can, and then move on.

My first mistake was taking a hot chilli from one of the tradesmen working on my house; I told him it was fine, but a minute or so later (when I was already in my car on the way home) it really hit and I was suffering for another 10 or 20 minutes. I decided that appropriate Restitution for this one was simply the embarrasment of ‘coming clean’, so I had to go back and tell him I’m not a real man, after all 😉

My second mistake was making a promise to the 7million7years who applied (and, were accepted) for my new 70 Millionaires … In Training! program that resulted in me (a) reducing the number of Foundation Members to 40 (was meant to be all 70) and (b) charging them $1 a year (it was meant to be totally free for life). We agreed that appropriate restitution was to donate $5 to a worthy charity for each Foundation Member ($5 x $40); I decided to do it for all 70 charter members (Foundation Members, plus full paying Premium Members) hence the receipt, above.

You gotta admit your mistakes and keep your promises …

__________________________________

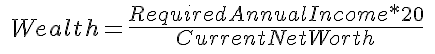

The 7million7year approach is not to measure wealth by the amount of money that we have, or some arbitrary sum that we might wish to have, or even some really complicated ‘secret formula’, but to measure wealth by this simple formula:

Where RequiredAnnualIncome = f { LifePurpose }

[AJC: which simply means that your Required Annual Income is some Function of Your Life’s Purpose i.e. they are -or, at least, should be – totally related!]

You are wealthy, in 7million7year terms, when:

“Wealth Factor” Wealth < 1

Or, you can just go by Ill Liquidity’s formula:

Let E be earn and S be spending. If E E QED. The latter part of the statement is redundant. What about “if you can finance it you can own it?”

I finance therefore I can? 😛

Adrian

A query – does that mean that the higher your “current net worth” the lower your “wealth”?

@ TraineeInvestor – Good point; for clarification, I should label it something like ‘Wealth Factor’, as it is NOT a dollar amount, as I am using it here.

Adrian,

I think you made a math error and inverted your definition of wealth with the definition you put down someone who needs a lot and is almost broke has an wealth number much larger than one.

If you want wealthy to be wealth > 1 then it should be (net worth)/ (required income * 20).

With that definition wealth =1 is where you have enough net worth that you could quit the day job.

-Rick

@ Rick – I think this ‘fixes’ both issues (yours and Trainee’s):

“Wealth Factor” Wealth < 1 ... otherwise, I will have to revert to my old standby: you don't need to be good at math to get rich! 😉

Using the inverse of your formula would be more intuitive.

BTW, doesn’t this implicitly assume some kind of draw-down rate approach that you usually don’t like?

BTW, I never advocated a fixed come hell or high water approach to draw down rates, rather a “intelligent” approach as you suggested.

Okay Jake… I like what you say and you seem like you’ve both thought about and done these things. So many other financial types just spin off the same old ambiguous mantra. But I get the feeling you’re open to giving specifics.

So… here’s me: I’ve just crossed the $1 million mark, almost entirely in cash earnings and post-tax.

Included in that, I’ve got around $150-$175k in a 401(k) from an old employer (it was more but lost about half in the crash and gained half the losses back).

Also in that, I’ve got about $150k in a SEP account, with around $40K of that invested in dividend-paying large caps with DRPs in place.

I’ve then got around $350k in a Money Market paying next to nada, waiting for me to get busy and invest it in something.

And then $300k in a savings/checking account, also waiting for me to move it into the investment account and then put it to work.

The rest includes a $20k municipal bond paying not so much… and a $45k piece of undeveloped lakeside property in Central America. And another $9k in a telecom stock (gifted to me)… plus another $20k in a second bank account.

We’ve got zero debt but also no house… we rent in a European city where cost and tax issues make buying prohibitive (though we’re US tax residents).

I’ve got at least 20 years before retirement and like it that way. Income is in the low-to-mid six figure range. I don’t like crazy risks but realize risks can be worthwhile.

So… now what?

@ Jake – Valid point; we ONLY use the Rule of 20 when PLANNING our Number (i.e. wealth) … when it comes to actual MM301 execution, we want to do something entirely different 🙂

@ Jack – What did you start with and how long did it take to get to your current networth? How long do you want to keep working and how much do you need to build up when you retire?

Then, I recommend that you do three calculations:

1. The average savings + compound growth rate that got you to where you are?

2. The average savings + compound growth rate required to get you to where you want to go?

3. If 2. < (or equal to) 1. then keep doing what you are doing! If not, then PUT YOUR CASH TO WORK!!