Please keep sending your questions and comments either via e-mail [ ajc @ 7million7 . com ] or via the comments; I answer as many personally and/or here as I can …

… for example, Mike asks:

Are your rules of thumb like making 15% year on year in the stock market still true in an environment when treasuries and inflation is so low?

One of the reasons pension funds are blowing up left and right is that there are assumptions on portfolio rises of 8% per year… so should you be pulling down those numbers of expected returns?

This is a great question … so much so, I’m wondering why anybody hasn’t challenged them before, considering the current market.

Yet, my answer would be – and was – and is:

We’re not concerned, here, with what stock markets are doing now, [not] like pension fund managers and traders are …

The reason is simple: we’re not trying to invest to achieve the greatest possible returns now, as traders and pension fund managers hope to achieve …

… we’re here simply to reach our [large] Numbers by our [soon] dates.

By ‘large’, we’re talking $7 million (give or take a few million) and by ‘soon’, we’re talking 7 years (give or take a few years).

We’re not talking this year, or even the next, or the next, or …. we’re totally focussed on that end result.

Besides, traders and fund managers who chase the market fail … and, fail miserably 🙁

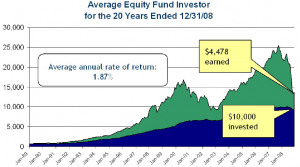

Here’s what happens to ordinary folk who try and time the market, because they are worried about [temporarily] low returns or are chasing [temporary] high returns:

This shows that no matter what gyrations the market had over the last 10 years – as shown by the green area – the typical investor never managed to keep up – as shown by the blue area – not by a small margin, but by a HUGE CHASM, managing a return of only 1.87%

Think about it: the average investor (that’s you and me) only managed less than a 2% return, over the 10 year period 1998 to 2008, when the market returned over 8%.

That’s worse than simply sticking your money in the bank!

[AJC: to show it’s not just a function of the current market, this huge discrepancy also held true for Dalbar’s earlier study]

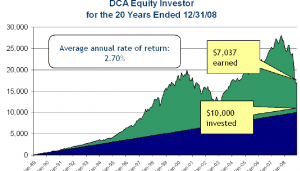

And, if you think that’s because the average investor is a know-nothing dolt and you can do better; here’s what professional fund managers managed to achieve:

2.7% … that’s the best that even the professionals could manage.

Why?

Because both professional fund managers and investors (yep, even those who BELIEVE that they are buy/hold long-term investors) switch in and out of the market, altering their strategy [AJC: a nicer phrase than greed and panic] as markets rise / and fall … obviously, timing things terribly.

That’s why when I talk about investing – and, the associated rules of thumb – I look at the average returns over a long period. I sometimes even advocate looking at the lowest average returns over a similar period.

Yes, if your Number is soon, then you will need to look up my references (they are sprinkled thoughout my posts) and choose more appropriate estimates and take your chances along with the rest of the speculating masses …

… but, for planning your Number and then acting out your strategy you can – and, probably will – do much worse than simply following my ‘rules of thumb’.

After all, I have made $7 million in 7 years – and, this blog is all about helping you do the same – using these exact, same strategies that I teach here.

* Footnote: in the interests of full disclosure, here’s what I told a reader on Monday:

I hope that everything here rings true; I try and give all stories from personal experience. But, not everything happened for me in a nice, clean order: for example, I only found out about the 20% Rule a couple of years ago.

Sometimes, I simply have no choice but to talk from personal experience about ‘rules’ that I found out about a little too late 😉

Adrian,

The lesson I would take is that individual investors, even professional investors fail to beat the market so often it’s foolish to try to beat the market myself.

Either

A) Accept the market’s average returns through buying low cost index funds and holding for decades to get long term average market returns.

B) Ignore the stock market entirely.

It seems the choice should be simple enough- if my date is soon and I need more than the historical market rates of return then B is the answer. I suspect for most readers B is the answer- they need far too high a % return to meet their goals without wild speculation.

-Rick Francis

The failure of investors and fund managers to come even close to matching the market is a pretty good arguement for indexing. Of course, if you combine indexing with a passive buy and hold strategy you give away any chance of beating the market as well.

Incidentially, plenty of studies have shown that rebalancing a portfolio of non-correlated asset classes will produce bette returns than simply investing in one asset class.

Aren’t pension funds also hit by the challenge of having enough liquid capital to withdraw funds regularly, and accept less risk because of it?

So they are trying to do Investing 201 and Investing 301 at the same time (aquiring weatlth and retaining it). I can see the conundrum.

@ Neil – Is that MM201 and MM301 at the same time? Or is it merely an attempt to apply Benjamim Graham’s / Warren Buffett’s Rule # 1: “Don’t lose money!”?

AJC,

Looking at most of the houses and investment properties for sale in Australia (SE Queensland), most of the net returns are 2-3% per year… seems strange when a fixed deposit in the bank is earning 6-7% yearly.

Seems like a great deal to make a fixed deposit but if things get rough the AUD could drop pretty fast like it did in 2008, wiping out the gains made by having a nice interest rate.

Sure is tricky to find the right balance of risk & reward.

From what you’ve found there must be better returns on investment, can you find anything yielding 7-10% today?

-Mike

@ Mike – I recently bought a commercial property to rehab/rent out at an expected 7% – 8% return (it’s now one of the two condo sites that I posted about a while back), other than that, no easy pickings for short-term players 🙁

Adrian,

7-8% is a really good deal. I agree you need to do a lot of looking.

What do you make of the fact that banks are offering 7% on fixed deposits? That’s higher than mortgage rates in some cases, seems like an easy way to get a good return in the next 1-3 years.

-Mike