This is one of my favorite posts; a great place to start for new readers, especially if you follow the links …

This is one of my favorite posts; a great place to start for new readers, especially if you follow the links …

________________

The traditional approach to paying off debt and personal finance (interchangeable terms, it seems, according to the popular media) is simple:

1. Tear up your credit cards : pay off debt : get new credit cards : goto 1.

2. Pay off all of your bad debt : all debt is bad : goto 2.

3. Save 10% : use to build an emergency fund : dip into emergency fund : goto 3.

What is the point of all those “goto”s, you may well ask?

Well, ‘goto’ is an inelegant way of writing computer code … it’s something that programming dinosaurs used back in the Dark Ages [AJC: when I used to work in the computer industry; they had ‘mainframes’ in those days].

And ‘goto’ here means that each step in the traditional personal finance investment plan (as in the sample plan, above) is iterative …

… it never ends.

You never really get out of debt, human nature being what it is (self-defeating, or everybody would be debt-free). You never really get rich, making money being what it is (really hard, or everybody would be rich).

Here, instead, is $7 Million 7 Year’s Patented 2-Step Wealth Generation System:

1. Start Investing

2. Deal with emergencies as they arise

Of course, you will immediately see the flaw in the above: I haven’t created a debt reduction strategy, an emergency fund, or a pay yourself first plan.

That’s simply because, if you follow my patented 2-step plan, you won’t need a separate debt reduction strategy, an emergency fund, or a pay yourself first plan!

Here are the principles upon which this strategy is built:

1. Paying off debt is investing

In previous posts, I’ve outlined my cash cascade; it works much better than any debt snowball, debt avalanche, or any other debt reduction strategy you’ve ever read about, because every single one of those ‘other’ plans works on the flawed assumption that debt is bad, therefore should be paid off as quickly as possible.

The reality is that 75% of your net worth should always be working for you … at the best possible after tax interest rate (taking your personal attitude to risk – and, your affinity to / aversion against certain types of investments – into account).

Keeping in mind that a dollar saved is EXACTLY the same as a dollar earned:

– Paying off a 13% (after tax) credit card instead of buying a 1% (after tax) CD certainly makes sense.

– Paying off a 4% APR (before tax benefits) home mortgage instead of investing in an income-producing property that may return 7.5% cash-on-cash (after tax benefits) does not.

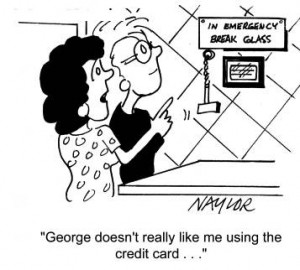

2. Creating an emergency fund is your first emergency

Let’s say that you create a $10k emergency fund; let’s also say that this fund is big enough to cover all likely emergencies.

Haven’t you just created your worst case outcome?

That is, haven’t you just depleted your investment fund by $10k?

And, if you didn’t have the ’emergency fund’ in place, isn’t that exactly what you would otherwise only needed to have done, but only in the event of an actual emergency?

Wouldn’t it be better, instead, to invest that $10k so that it is always working for you, emergency (very unlikely) or no emergency (very likely)?

But, how would you deal with emergencies ‘as they arise’?!

Well, you could simply create a source of borrowings that you can tap into only when needed (e.g. a line of credit against your home; a redraw facility against your 401k; a 0% APR credit card, sitting there – unused – just for this purpose).

If you just start investing, you will soon want to become successful by investing more and more.

And, it won’t take you long before you you are cutting costs, paying off your credit cards, putting more and more aside, reading everything that you can about personal finance and investing, and so on …

… simply because you will want to invest more. It’s exciting and addictive.

That’s why these two simple steps will change your life, forever.

Go ahead, try it: my 2-step plan comes with a Lifetime 100% Compounded Money Back Guaranty 😉

Well said Adrian! Love it!

What happens in a tight money recession when all your credit evaporates and your invested 10k emergency fund is now worth 5k?

Do you literally keep a month or less in cash?

How about money “in the chamber” (as it were), ready to deploy to an amazing opportunity? Or do you keep money earmarked for startups in other investments and liquidate as needed?

Pingback: How to retire in 7 years …- 7million7years

Pingback: SOS debt management: education is better than information

Yeah, I have to go with your 2 step plan. All my years in PF it seem to work best than the cookie cutter approach

Pingback: Why cookie-cutter personal finance doesn’t work …- 7million7years