Welcome MoneyHackers!

Welcome MoneyHackers!

Here are three of my favorite posts to get you started; if you want to find out:

1. If $1 million will be enough to retire with, then click here, or

2. How much house you can afford, then click here, or

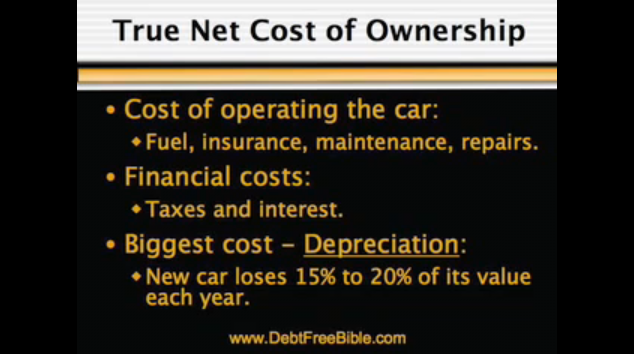

3. Why buying a new car is such a losing proposition, then click here.

Otherwise, please enjoy this article, then bookmark my home page (click here) and come back often …

____________________________________________________________________________________________

For those who don’t already know, I am a member of Money Hackers – a group of personal finance bloggers – and Lydia has just interviewed me; you can read the interview on the moneyhackers.net site by clicking here, or read the extract below:

What influenced you to start writing 7million7years?

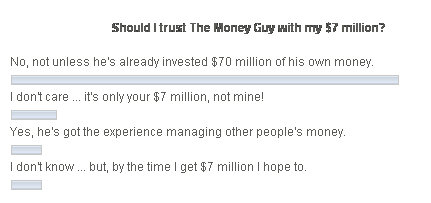

I started out $30k in debt and made $7 million in 7 years, but the road was bumpy and I found that I had to learn most of the hard financial lessons myself. I started my blog so that others wouldn’t make the same mistakes that I did.

What encouraged you/where did you hear about becoming a 7 time millionaire in 7 years?

When I started out, I had two businesses which barely paid their own way, and I was in serious debt. But, I had no clear goal or reason to do any better. That all changed when I discovered my Life’s Purpose, which is to always be traveling physically, mentally and spiritually. I suddenly realized that I would need both a lot of free time and plenty of money to achieve what I really wanted in my life. In fact, I calculated that I needed $5 million in just a few short years. That epiphany started the amazing journey that took me from $30k in debt to $7 million in the bank in just 7 years.

What financial topic do you most enjoy blogging about?

My own financial journey and showing others how they can also free themselves from a life of work, debt, and drudgery by applying the same financial lessons that I learned. There are no scams or schemes needed to replicate what I achieved, if they just follow some good, old fashioned financial advice.

What crucial point have you learned through this experience of gaining 7 million?

Your money is there to support your life, yet most people act like it IS their life. No amount of money will ever be enough if you have no clear idea what you really need the money for. Find out what it is that you really want to do in with your life (and by when), then calculate how much passive income that you will need to get you there. Then come to my blog to find out how to safely build that income stream. But, once you have enough … STOP and smell the roses.

What 3-5 blogs are essential to understanding how to save money?

My blog isn’t really about frugal living and saving money, but more about accelerating your income through work, business, and investing. It’s also about protecting your wealth, through passive investment strategies (for example, using stock or real-estate). So, if my readers want to know more about saving than investing, then I recommend that they read:

1. JD Roth’s Get Rich Slowly

2. Steve’s Brip Blap

3. Pinyo’s Moolanomy

What is some financial advice you could give our readers?

Most people don’t really know how much house they can afford, so let me give your readers some very specific advice that will help them through every stage of their own financial journey: never have more than 20% of your Net Worth invested in your own house, and no more that 5% in all of the other ’stuff’ that you own (e.g. cars, furniture, computers, etc.). You can adjust the equity in your house by refinancing periodically (always lock in your interest rate when it is below 6% – 8%).

This means that you will always be investing at least 75% of your Net Worth, which is the only real chance that you have to get out of the financial rate race.

If you have your own blog, I’d like to hear how/why you started it … there’s plenty of space to share in the comment section, below …

Like you, I receive a lot of spam … fortunately Google’s g-mail picks most of it up and automatically dumps it into the ‘trash’ folder for me.

Like you, I receive a lot of spam … fortunately Google’s g-mail picks most of it up and automatically dumps it into the ‘trash’ folder for me.

Trent at A Simple Dollar poses an equally simple question:

Trent at A Simple Dollar poses an equally simple question:  A week or two ago, a reader – who shall remain nameless as they are currently in negotiations – asked for some advice on selling their business:

A week or two ago, a reader – who shall remain nameless as they are currently in negotiations – asked for some advice on selling their business:

What do cars and radioactive material have in common?

What do cars and radioactive material have in common?