My soon-to-be-nephew is having his wedding at our house; he’s an event organizer (amongst other things) so this is his opportunity to create his (and my niece’s) ideal wedding …

My soon-to-be-nephew is having his wedding at our house; he’s an event organizer (amongst other things) so this is his opportunity to create his (and my niece’s) ideal wedding …

… we were, of course, delighted to be able to lend our house.

As he was supervising the erection of the marquee over our tennis court and false flooring over the pool, we were chatting about wealth.

During the course of discussion, the subject came up of how much do you really … and, ideally … need?

What is the Perfect Number?

If you’ve been following my blog for a while, you will know that I’ve said that you need as much passive income as you need to live your Life’s Purpose.

Even without knowing your Life’s Purpose, though, I can still tell you roughly what your Perfect Number should be:

You should aim to live no better than your closest group of friends.

Let me explain with a personal example …

We have a long-standing group of friends.

We eat often eat together. We party together. We travel together.

Not always. Not only. But, often enough.

Now, how would you feel if you travel coach, most of your other friends travel coach, but one of your friends is always at the front of the plane?

How would you feel if you like to eat out at a mid-priced restaurant once every couple of weeks with your friends, but one of your friends is always trying to arrange 5-star dining? And, 5-star hotel’ing?

I think your friend would eventually price herself out of your group of friends.

Well, I am in danger of becoming that friend.

Our friends are all quite well-off, because they are all professionals (both husbands and wives) drawing great incomes for many years. All of our children privately school together, and vacations are now flying coach (with kids) or business class (without kids), staying at international 4-star resorts at least once, and probably twice, most years.

But, our house is clearly the best in the group. Our cars are the best (and, could be better, but I’m starting to realize that I should hold back a little). And, we could be flying business class (sometimes even international first class), and easily stay in 5-star hotels.

In short, we have to be careful not to make the difference obvious.

That’s why I told my nephew (to be) – as I am telling you now: aim to live no better (but, no worse) than your closest group of friends, assuming that you wish them to remain your friends.

I can add a little more:

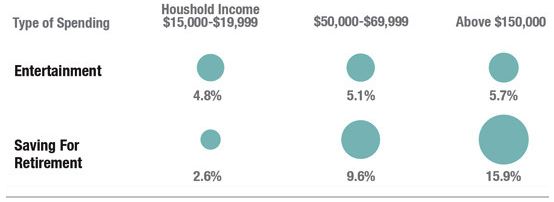

– Aim to be towards the top of your circle in terms of sustainable annual income.

– Aim to have a buffer, so that you can maintain that standard even if something goes wrong.

[AJC: This is not the same as an emergency fund: this means, for example living on the same $50k p.a. as your friends, but actually earning $70k p.a.]

– Aim to be able to maintain that standard of living (with buffer) when you begin to live Life After Work.

– Make sure that your Life After Work (i.e. very early retirement) makes you still ‘look’ busy

[AJC: Sitting on a beach all day while your friends still 9-to-5 it 50 weeks a year will just as quickly put you in the ‘former friend’ category as flashing your cash]

So, how much money do you really need?

Step 1: Take what your friends are earning and add 20% buffer

Step 2: Multiply that by 20

Step 3: Add the amount remaining on your mortgage (or, what your mortgage would be if you bought one of the better houses owned by your friends)

Step 4: Add any additional ‘crazy money’ that you need for some of your ‘keep busy’ Life’s Purpose activities.

Step 5: Double your final total for every 20 years until you expect to be able to accumulate that amount of money (or, add 50% for every 10 years), to account for inflation.

That should give you a very practical Number … you might even say your Perfect Number 😉

Now, you just need to go out and get it.