1998 capped a long period in my life when I was imprisoned by a circle.

I suspect this is the same for most. What separates me from the others – and, I suspect you, too – is that I broke out.

The ‘circle’ was my life and the things that I was trying to deal with:

– Keeping myself sane in an increasingly mad world

– Keeping my family safe, fed, and healthy

– Trying to earn a decent living to pay the bills and keep a roof over our heads.

This type of existence is inherently inwardly focused … we focus on ourselves, our immediate family, our friends, and our work colleagues (probably in that order) and little else.

This type of existence is inherently inwardly focused … we focus on ourselves, our immediate family, our friends, and our work colleagues (probably in that order) and little else.

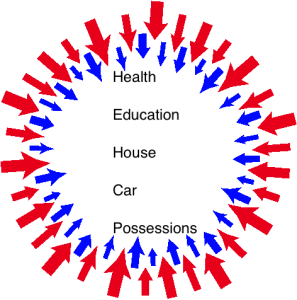

The reason why it’s a prison – well, a financial reason (there are others beyond this scope of a humble personal finance blog) – is that our ‘investments’ are similarly inwardly focused; aside from what little we manage to save in our bank accounts and 401k’s, our so-called investments center around the things that make our inner-circle lives a little better.

We invest in our health (as much as we can – or feel motivated to do), our education (often because our parents tell us that “it’s an investment in our future”), our home (because that’s what our parents did) and, of course, our cars & possessions (because that’s what our friends and colleagues do), and so on.

Why do we invest?

So that when our income stops we can try and continue living within our circle and simply maintain what we have?

But, when I broke out of that circle my life began to change!

My First Big Realization was that my life wasn’t about my money … so why was I spending so much of my life – that precious, finite resource – attempting to earn money?

When, in 1998, I found my Life’s Purpose, which included what was in the circle (family, health, and so on) but also a lot more than I had ever felt desirable or even possible, I was forced to look outside the circle … way out.

Interestingly, and logically, I also realized that the investments that I had been making for my circle-bound future would no longer be adequate for a far less bounded life.

Not only did my thinking have to move beyond the circle, but so did my finances. And, if my finances wouldn’t be adequate for the life that I really wanted to lead, then neither would my investments!

Not only did my thinking have to move beyond the circle, but so did my finances. And, if my finances wouldn’t be adequate for the life that I really wanted to lead, then neither would my investments!

So, in 1998, my investment strategy also shifted … and, shifted dramatically.

[AJC: if you want to understand a little more about this process, then check out this free site: http://site.shareyournumber.com/]

No longer would I try and upgrade my home and my car.

No longer would I try and upgrade my lifestyle in an attempt to keep up with the Jones’ (and, I had plenty of those to try and keep up with!) …

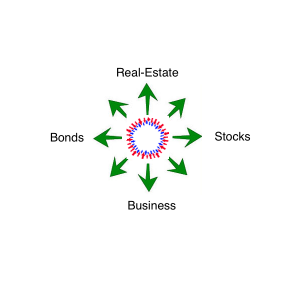

… I would simply begin to apply every spare penny to investing outside of the circle: in true investments that I could not eat, live in, drive, or share over a beer.

Now that those investments have born fruit, finally freeing me up to live my Life’s Purpose, I realize that living outside of the circle has actually also helped me live within.

The difference is that my inner circle is no longer my prison but my sanctuary.

The sooner that you identify what is in your circle and what – if anything – outside of the circle truly drives you, the sooner you will be motivated to seriously start making money and investing.

Then this blog will suddenly become very interesting to you 😉