1998 capped a long period in my life when I was imprisoned by a circle.

I suspect this is the same for most. What separates me from the others – and, I suspect you, too – is that I broke out.

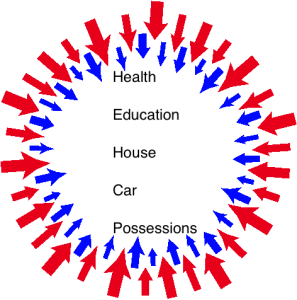

The ‘circle’ was my life and the things that I was trying to deal with:

– Keeping myself sane in an increasingly mad world

– Keeping my family safe, fed, and healthy

– Trying to earn a decent living to pay the bills and keep a roof over our heads.

This type of existence is inherently inwardly focused … we focus on ourselves, our immediate family, our friends, and our work colleagues (probably in that order) and little else.

This type of existence is inherently inwardly focused … we focus on ourselves, our immediate family, our friends, and our work colleagues (probably in that order) and little else.

The reason why it’s a prison – well, a financial reason (there are others beyond this scope of a humble personal finance blog) – is that our ‘investments’ are similarly inwardly focused; aside from what little we manage to save in our bank accounts and 401k’s, our so-called investments center around the things that make our inner-circle lives a little better.

We invest in our health (as much as we can – or feel motivated to do), our education (often because our parents tell us that “it’s an investment in our future”), our home (because that’s what our parents did) and, of course, our cars & possessions (because that’s what our friends and colleagues do), and so on.

Why do we invest?

So that when our income stops we can try and continue living within our circle and simply maintain what we have?

But, when I broke out of that circle my life began to change!

My First Big Realization was that my life wasn’t about my money … so why was I spending so much of my life – that precious, finite resource – attempting to earn money?

When, in 1998, I found my Life’s Purpose, which included what was in the circle (family, health, and so on) but also a lot more than I had ever felt desirable or even possible, I was forced to look outside the circle … way out.

Interestingly, and logically, I also realized that the investments that I had been making for my circle-bound future would no longer be adequate for a far less bounded life.

Not only did my thinking have to move beyond the circle, but so did my finances. And, if my finances wouldn’t be adequate for the life that I really wanted to lead, then neither would my investments!

Not only did my thinking have to move beyond the circle, but so did my finances. And, if my finances wouldn’t be adequate for the life that I really wanted to lead, then neither would my investments!

So, in 1998, my investment strategy also shifted … and, shifted dramatically.

[AJC: if you want to understand a little more about this process, then check out this free site: http://site.shareyournumber.com/]

No longer would I try and upgrade my home and my car.

No longer would I try and upgrade my lifestyle in an attempt to keep up with the Jones’ (and, I had plenty of those to try and keep up with!) …

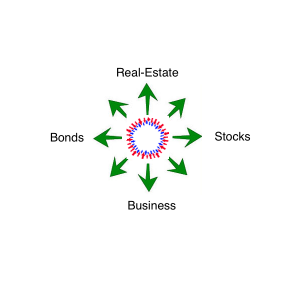

… I would simply begin to apply every spare penny to investing outside of the circle: in true investments that I could not eat, live in, drive, or share over a beer.

Now that those investments have born fruit, finally freeing me up to live my Life’s Purpose, I realize that living outside of the circle has actually also helped me live within.

The difference is that my inner circle is no longer my prison but my sanctuary.

The sooner that you identify what is in your circle and what – if anything – outside of the circle truly drives you, the sooner you will be motivated to seriously start making money and investing.

Then this blog will suddenly become very interesting to you 😉

I take a bit of a philosophical approach to life, and yet, every now and again, I am surprised at how the same information, presented slightly differently, can make a whole aspect of life suddenly shift into focus.

This post was like that. You’ve said nothing new here, but just that image of a circle, and the importance of having to invest outside the circle, I found really powerful.

Thanks for this.

I think over the past 3 – 4 months I’ve fallen into the trap of slowly beginning to point more energy, time and “investment” towards the inwards circle, after having had a pretty good run of building outside the circle. This post has reminded me to get back to doing the things that build my future again, and to not allow the activities that perpetuate my current existence to consume all my resources.

I think one has to regularly check yourself. Those inward-focused requirements have a subtle way of trying to stop us from investing outside of the circle.

so simple yet powerful.. for ppl that is trap and does not know the way out.

@ Ashton – IMHO it’s only by investing outside of the circle that we really enhance/protect what lies within. Thanks for sharing.

Pingback: If you were interviewing me …- 7million7years

Hi Adrian,

I LOVE this blog. This is exactly how I feel. I want to break out, I will break out! I have been reading and reading your site and just ordered a bunch of books from Amazon on how to make money on real-estate. I would have so many questions to you, mostly about money how to make the first step with the bank. I have $130K in my $330K home and I think I need to tap into that to make my first purchase. How exactly do I do that, where do I start? Do you offer any guidance? I will greatly appreciate any drop of your wisdom. Please never stop writing.

ILDY, the equity in your own personal home might be the lowest rate you can get thats a good start, if the bank will give you more money. They have tightened things up you might not be able to get what you think you can but start there. You might read this book, its a decent plan for single family homes. by Elaine zimmermann .. .she found a formula and stuck to it.. I suggest buying something very close to you at first, you will know the area buy in a nice neighborhood with good schools, buy at the right price you make money when you BUY not when you sell.

http://product.half.ebay.com/How-to-Retire-With-a-Million-Dollars-by-Elaine-Zimmerman-and-Elaine-Zimmermann-1998-Hardcover/218832&tg=info

Hi Adrian, Thanks for the reply I will definitely read the book you recommended. Could you expend on this statement a little or maybe you have some related blogs about this on your site? “…buy at the right price you make money when you BUY not when you sell.”

@ ILDY – It was Jimbomillions (another reader) who made those comments rather than me; however, I have posted here:

http://7million7years.com/2012/03/31/make-money-when-you-buy/

Thanks Adrian and Jimbomillions for your posts. I have a question regarding cash flow/leverage: I will buy my first house form an equity line of credit. The monthly payment will be about $500, I can rent it for about $1500/mo. So I will have a positive cash flow, but with this move I’ll burn up my most of my leverage. How do I go about acquiring my second house? Any suggestions?

that is potentially a great return $500 monthly payment, for $1500 in rent. How much % are you putting “down” with your equity line of credit? if you can replicate at $500 montly payment for $1500 in rent each month you should have NO problem raising more capital. What country are you purchasing this home in?

The place is NY, USA. From your question I feel that I might be doing this wrong. Please let me know. I was planning to take all the $85K from my equity line of credit to buy the property. With 4.25 interest rate, my PI is $418 adding Prop.Tax and Home Ins. it comes to $800 (not $500, my bad), so I’d have an income of $700/mo when rented. If I raise more capital for another down payment, will I be able to get another mortgage? Remember I already have one on my own home and will have an equity line of credit out. With these 2 things my debt to income rate is 31%. I know you can go up to 50%. Plus I can add the rent as an income. Do you think I’d get another mortgage for my second rental?

Pingback: 7 Million 7 Years – Best of the Best Blogger Series

Pingback: An interview with AJC …- 7million7years