Applications for the new $7 Million 7 Year Wealth System Guided Learning Experience are now closed. Thanks to all of those who applied … and, congratulations to those 30 who made it!

Applications for the new $7 Million 7 Year Wealth System Guided Learning Experience are now closed. Thanks to all of those who applied … and, congratulations to those 30 who made it!

I’m not going to encourage my other readers to join, as I can’t see the point of paying $97/year for something that you could have got for free (well, for $1 a year). Anyhow, no advertising allowed on this blog … and, that even applies to me!

Instead, I hope that you will keep reading this blog, and that it will inspire and help you to make millions the good, ol’ fashioned way 🙂

_____________________________________

Yes, I am well and truly diversified …

Yes, I am well and truly diversified …

… and, it sucks!

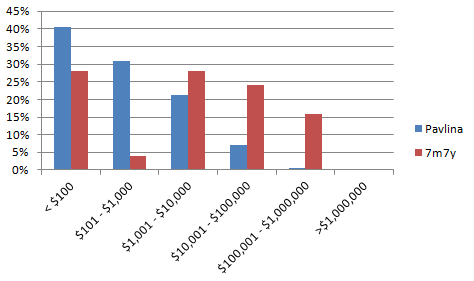

Here are my current holdings, roughly:

$5.0 million – House in Australia

$1.5 million – House in USA (soon to be a rental)

$2.5 million – Cash in Bank/s

$1.0 Stock in UK (actually, 70% has just been converted to cash)

$1.0 million – Equity in 5 condos

$1.0 million – Equity in two development sites (could be up to $3 million – $6 million once permits are issued)

$1.0 million – Value of business (I still have a finance company running on ‘auto-pilot’)

… aside from the fact that I’ve over-invested in my Aussie house [AJC: see this post for the problem and how I intend to fix it], you can see why I am not happy:

– Too much in cash,

– Too much overseas, in chunks too small to be meaningful

– Too many ‘small’ chunks of $1 million

Ideally, I would like to bring some of those small chunks together, merge them with my cash (like so many drops of mercury) and do something useful with them …

…. by ‘useful’, I mean plonk as much as the bank requires into my two development projects, then use the proceeds to buy as many investment properties in the $1 million to $3 million price range that I can find, as long as the net result is free cashflow of $500k+ p.a.

Nowhere here do you see me saying:

– 30% in cash,

– 30% in real-estate,

– 30% in stocks

– 10% in venture capital

Mine will look more like:

– 80% – 90% real-estate (albeit, over a number of properties, rather than just one big’un),

– 5% – 10% cash for contingencies (up to approx. 2 year’s living expenses or $500k to $1 million, whichever is the lesser)

– 5% – 10% for ‘fun projects’ (e.g. venture capital investments).

Why so much in RE?

[AJC: It doesn’t have to be RE; how I invest my money is not how you should invest yours … but, the principle of NON-diversification is what’s important, here. And, I should clarify that, too: for you, non-diversification could be 95% in TIPS; 80% in AN index fund; 90% in just 4 or 5 stocks … in other words: it means, avoiding spreading across asset classes]

I can’t find the online reference, but Warren Buffett was asked at the 2008 Berkshire Hathaway AGM (which I attended, so I am paraphrasing exactly what I heard, here) how much of his net worth he would place into one position (Berkshire Hathaway doesn’t count, because it’s really a conglomerate).

Warren said that his biggest problem right now is that his investment war chest is so large that he is forced to buy many investments, however, he did point out that he was very happy in days long gone, when his investment in AMEX comprised nearly 60% of his net worth.

Charlie Munger (Warren’s long-time business partner) said that he would be equally happy to have close to 100% of his net worth in just one outstanding investment.

BTW: Charlie is a real ‘character’; short on words … long on wisdom!

Having sat on both sides, I can tell you that – right now – I am NOT happy being so ‘diversified’ … it annoys me, and I feel hamstrung in that I can’t bring my full financial weight to bear on any project.

But, each to their own … it’s just that certain rich peoples’ “own” = non-diversification 🙂

_______________________________________

Adrian J Cartwood is on FaceBook … come and be friends!

_______________________________________