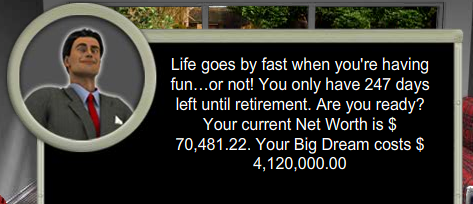

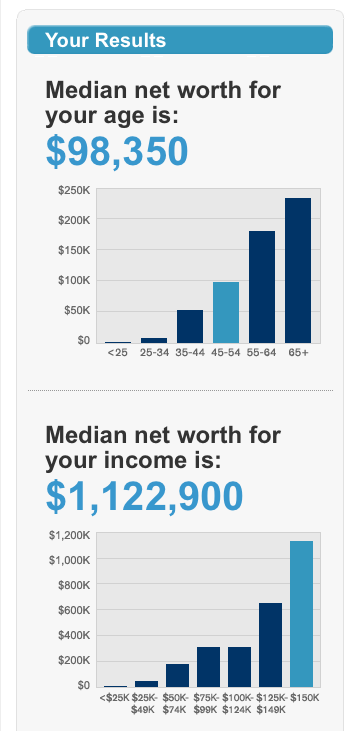

A couple of weeks ago, I posed the question: Will a million dollars be enough when I retire?

A couple of weeks ago, I posed the question: Will a million dollars be enough when I retire?

There was much discussion that makes it clear that you must also ask: WHEN do you want to retire?

You see, 4% inflation (say) eats away at your money, such that if you were to retire in 20 years – which is when you hope to get your $1 Million bill – it’s only ‘worth’ $500,000.

And, inflation continues even after you retire, which then means that you probably need to earn at least 9% on your Million Dollar Bill (4% to ‘cover inflation’ and 5% to spend) … this still leaves you only the equivalent of $25k today to live from (assuming that you want your $25k ‘retirement salary’ to at least keep up with inflation for as long as you need an income).

Assuming that this makes sense, let’s see how practical this Million Dollar Retirement Goal really is:

There are two schools of thought:

– There are those who believe that you should aim to approximate your pre-retirement salary in retirement, and

– There are those who don’t.

Now, I am in the second group – as are most people who have tried the same exercises that our 7 Millionaires … In Training! tried.

For example, my salary throughout almost all (bar the last 3 years) of my working life was less than $50k – $100k (incl. fringe benefits) and my wife had to keep working, BUT that was a purposeful strategy designed to get me to a retirement in just 5 years (instead of the notional 20 years) i.e. at 49 y.o. on the equivalent of $250k+ a year income for life (indexed for inflation) post-retirement.

But, this post is aimed at those new readers who are still in the first group … they, too, fall into two (sub)groups:

– Those who believe that they need at least 100% to 125% of their final salary in retirement (because, they say, you spend more in retirement due to travel, leisure activities, and escalating health care costs as you age, etc.) , and

– Those who believe that they need only 75% to 99% of their final salary in retirement (because, as these other ‘experts’ say, you need less in retirement as your children are grown up and educated, weddings are already paid for, house is paid off or downsized, etc.).

… at least, that’s how the personal finance columnists seem to be split.

So, in our example from the last post, we work backwards:

Somebody who aims to retire with $1 Million in 20 years time is really saying that they want to live off an annual income of roughly $50k in retirement (that WE now know is only ‘worth’ $25k a year), which means that their final salary will probably also be $50k (+/- 25% depending on which financial ‘guru’ they happen to follow).

Now, if you follow $50k in 20 years time all the way back to today, that person is probably earning $25k today (i.e. assuming that they earn CPI salary increases for the next 20 years) …

… so, now we can work forwards again:

If you have a starting salary (i.e. today) of $25k and aim to retire with $1 million in the bank in 20 years, you will need to set aside about 45% of your gross salary AND earn 9% on your money (after fees and taxes) AND have a house that you can free up at least $250k from when you do retire (e.g. by downsizing or moving into a very cheap rental).

Of course, if you can save 45% of your salary for 20 years, then you must be in the Salary-LESS-45%-In-Retirement camp, which is another story altogether 😉

So, it seems to me that getting to $1 mill. in 20 years for somebody on a salary of $25k is all bar impossible … and, even if you do scrimp, save, and ‘frugal’ your way there, you have only made it to the ‘lofty heights’ of living off about twice the poverty line, for a two-member household:

2008 HHS 100% Poverty Guidelines

Members of household————- 48 Contiguous States———–Alaska————–Hawaii

1———————————$10,400 ———————–$13,000————– $11,960

2———————————-$14,000 ———————–$17,500—————–$16,100

3———————————$17,600 ———————-$22,000——————$20,240

4——————————-$21,200————————–$26,500——————-$24,380

For each additional person, add—–3,600———————4,500————————-4,140

SOURCE: Federal Register, Vol. 73, No. 15, January 23, 2008, pp. 3971–3972

So, I think the Million Dollar Retirement Goal really is a myth – or, at least a very low bar to aim for – how about you?

This is rapidly appearing to become a blog about your Number … of course, that’s not the case: it’s a blog about money, specifically about how to make $7 million in 7 years, but you can pretty quickly see that having a real financial goal in mind is a powerful focusing tool.

This is rapidly appearing to become a blog about your Number … of course, that’s not the case: it’s a blog about money, specifically about how to make $7 million in 7 years, but you can pretty quickly see that having a real financial goal in mind is a powerful focusing tool.