Where do you keep your money if you want to buy a house in, say, 7 years?

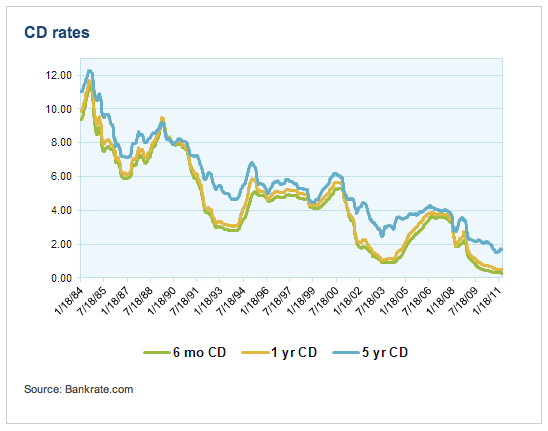

If you keep it in the bank, you’ll find rates up around 5% if you can commit to a 5 year term.

Given that inflation is currently running around 1.7%, you’re heading for a very small gain.

That’s why many choose to put their money into mutual funds …

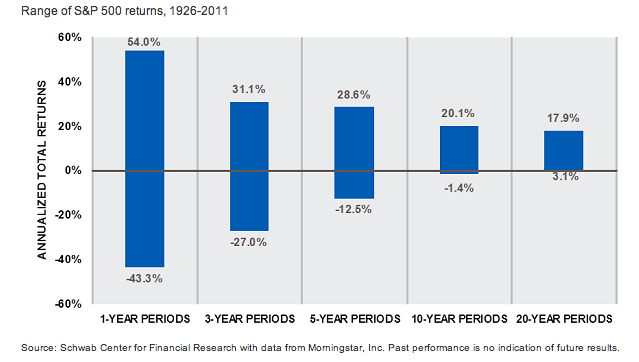

Despite the crash, returns from investing in a low-cost Index Fund (say, one that mirrors the S&P500) have been up to 28.6% for any 5 year period that you care to nominate in the past 85+ years.

Now, that’s certainly a lot better than CD’s (long-term bank deposits).

But, there’s a catch … and, it’s a big one!

Whilst’s CD’s virtually guarantee their admittedly paltry return, there’s no guarantees in the stock market …

… and, there has been at least one 5 year period where the S&P500 has lost 12.5%.

But, let’s look at the downside v the upside: that’s a potential 12.5% loss each year for the 5 years … compounded (meaning your savings will halve in a little less than 7 years) … but, you may gain up to 28.6% annual return (meaning you may double your savings every 2 years).

Compare that to the measly 5% return (before inflation) from CD’s and it seems like no contest, which is why many Americans are opting to use mutual funds as a mid-term savings vehicle, but …

It’s a huge mistake.

You see, it might be fine if you already had the deposit for the house saved up, and you were just setting it aside for 7 years. If so, and if this were me, I might very well elect to buy units in a low cost Index Fund rather than scraping by with a CD.

But, if I had the deposit already, I would more likely just go ahead and buy the house now, and rent it out if I wasn’t yet ready to live in it.

But, the reality is that most people need that 7 years to save for their deposit. And, that’s a whole different ballgame, because now you are putting aside a little every month and, over that 7 year period, slowly building up your deposit.

This means, your money is really only going to sit in your investment or savings account on average just for 3 years.

Now, your risk of loss is up to 27%, almost as much as your potential gain of up to 31%, and that means you are gambling, not saving.

This is one of very few cases that I have found where common financial wisdom is correct …

… the minimum period for committing your funds to the stock market should be 5 to 10 years, assuming you are not prepared to gamble with your starting capital.

And, if you are prepared to play the market, well, that’s a subject for a whole other post …

So – and, unfortunately – the best place (indeed, the only sensible place) to keep your money safely parked for up to 7 years is in CD’s 🙁

Adrian,

I’ve puzzled over this question as well.

Are there alternatives to CDs that you might consider? What about lending money through prosper.com or a similar outfit?

Best,

James

@ James – CD’s are effectively guaranteed; P2P is totally unsecured … opposite ends of the spectrum, really:

http://7million7years.com/2011/03/17/the-problem-with-p2p-lending/

Pingback: The myth of asset allocation …- 7million7years