What % of your retirement ‘nest egg’ can you safely withdraw each year, to make sure that you money lasts as long as you do?

Many would say that this is a question best answered by highly educated practitioners of the highly specialized field of Retirement Economics, who will give you an answer – or, more likely, a range of answers – accurate to many decimal places.

But, I can give you a single answer …

… one that is accurate to at least 17 decimal places, yet I am not an economist of any kind.

You see, Retirement Economics is an oxymoron.

Why?

First, let me give you an excellent example of what retirement economics is …

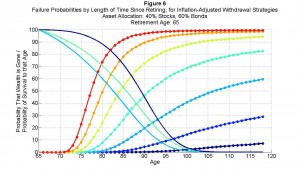

In his blog dedicated to pensions, retirement plans, and economics, Wade Pfau provides the following chart:

It superimposes two charts:

– one shows descending survival rates for men, women and couples who retire at age 65.

For example, if you retire at 65, there’s only a roughly 18% chance that at least one of you will live past the age of 95. Reduce that to 90, and there’s a 40% chance that one of you will survive.

– The other is an increasing probability that your money will run out before you do the larger the % you withdraw from your retirement portfolio.

For example, if you only withdraw 3% from your portfolio (if invested in the exact 40%/60% mix of stocks and bonds assumed by Wade) then there’s almost 0% chance that you’ll run out of money by the time you reach 95 (and a small chance thereafter).

But, there’s a 30% chance that you’ll run out of money by age 95 if you increase that ‘safe’ withdrawal rate to just 5%.

You’re supposed to use these ‘retirement economics’ to make decisions like:

“Well it’s very likely that either my wife or I will live to 95 and we don’t want our money to run out, so we’ll invest all of our savings in a 40% stocks / 60% bonds portfolio, and we’ll only withdraw 3% of it each year just to be sure that our money won’t run out.”

That seems like sound economical judgement for the average person …

… BUT, you are not average!

For better or worse, you are … well … you.

Besides the obvious [AJC: who says you want to wait until you’re 65 to retire?!], when YOU are 95 (albeit in the 10th percentile), how happy will you be if your money has either either already run out or there’s a reasonable chance that you will soon be out of money, hence out of care?

I would argue that only a 100% chance of your money outliving you is acceptable.

Even then, only with a LARGE buffer, so you never need to worry about even the possibility of your money running out!

In my opinion:

Only a 0.00000000000000000% withdrawal rate is acceptable.

Now, 0% does not mean withdrawal nothing, but it does mean having a sustainable, self-regenerating supply of income; this is not as hard to achieve as you might think.

For example, you can create an ongoing stream of income from:

1. Inflation protected annuities (albeit expensive)

2. TIPS (albeit a low return)

3. 100% owned real-estate (albeit, needs management)

4. Dividend stocks (my least preferred as they are sometimes a sub-par investment that tends to rise-fall with the markets).

Remember, when you retire, you want not only ZERO chance that your money runs out, but you don’t even want to get anywhere near to zero by a wide margin.

Don’t you?

Well said. Drawing down principal to fund living expenses is a huge gamble – a few bad years at the start and things will fall apart pretty quickly.

The other issue with drawing down principal is that if a problem arises after you have “retired” getting back into working mode is not easy – and gets harder as you age. This is why, although I have hit my number, I will carry on working for a bit longer – I’d rather work for an extra year or two now to give myself a margin for safety than face the risk of having to find employment when I’m in my sixties or beyond.

As an aside, inflation protected securities aren’t always easy to acquire in some countries and the annuities I’ve seen so far are so badly priced I wouldn’t touch them.

Question: what about preferred stocks?

Cheers

traineeinvestor

@ Trainee Investor – Yes, preferred stocks, too … esp. the ones that Warren Buffett prefers 😉

Hi Adrian

Yes, but remember that Mr Buffett often negotiates a better deal than humble mortals like I can get.

Cheers

traineeinvestor

My goal is to have a little bit of all those buckets…right now I am trying to build the dividend portfolio.

@ Evan – congratulations. When did you retire?

Retire? I have decades buddy lol

@ Evan – For clarification, then, I do NOT recommend shifting to these strategies until AFTER you retire 😉

Pingback: Copying the magician …- 7million7years