That’s why I was so excited a number of years ago (very early on in my Financial Re-birthing Process] to come across John Burley’s ‘No Budget Budget’.

That’s why I was so excited a number of years ago (very early on in my Financial Re-birthing Process] to come across John Burley’s ‘No Budget Budget’.

For those who don’t know him, John Burley is a financial spruiker (originally, on the subject of ‘wraps’ for real-estate … something that I have never tried myself, so something that I can’t really comment on); after hearing him speak, I tracked down one of his courses that covered basic financial improvement “in 31 Days” …

… I don’t think I ever got past Day 1 or Day 2, but I’m really glad that I tried his ‘no budget budget’. It’s the ONLY personal budget that I have ever tried (and, don’t even get me started on the subject of business budgeting!).

Basically, the process consists of writing down every single dime that you spend (cash, check, credit) for a month. That’s it!

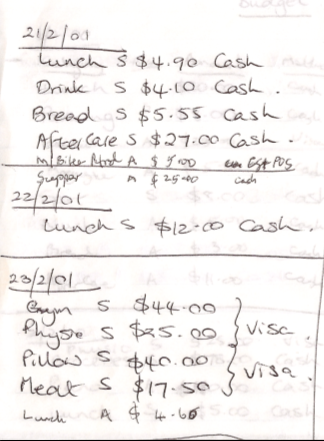

When I was cleaning out the house for ‘our big move’ recently, I found the actual budget that I had put together … it spans all of 3 pages (part of page 1 is scanned and reproduced here); a small ‘price’ to pay for financial freedom 🙂

Here’s how it works:

1. Grab a blank sheet of paper and a pen (actually, a little pocket notepad and pencil is ideal … but I kept a folded sheet of paper in my pocket and my wife kept a little notebook and pencil in her purse and every night she would tear the page out that she used and give it to me to add to my sheet).

2. EVERY DAY FOR EXACTLY ONE MONTH [AJC: you don’t have to start on the first day of the month; any day – like TODAY – will do] I wrote on that sheet of paper:

– The Date (each day I started a new section on the piece of paper … when you try this, you should be able to fit a week or so on each sheet)

– What we bought (e.g. lunch; drink; bread; newspaper) … we did this for every single purchase!

– Who bought it (A for me; S for my wife; I guess we would also need to add Ad and Ta for our children if we were starting this No Budget Budget now)

– How much it cost (inc. taxes etc)

– How we paid …. we used a simple system eg Cash, Visa, Check

That’s it; one month …

Also, we added a new ‘last day’ of the month, so that we could write in 1/12 of any annual expenses (eg insurance) whether paid for in that month or not.

You can see that we did this in Australia 9 years ago [AJC: the date 1st Feb, 2000 is written as 1.2.00 in Australia]

You can also see that we were mainly a ‘cash society’ back then as only the haircut (mine) was paid by Visa [AJC: at $28 back then, I must have had WAY more hair than I do now] …

So, we simply kept a log of all of our spending for each day, in exactly the same way that we did for Feb 1 for the whole month … of course, Feb is a dumb month to choose, because it’s the shortest.

I can’t find the summary page, but I recall it being something like $1,000 a month that we were spending then.

That tells you what you’re spending … now, compare that to what you’re earning (after tax):

- Annual income twenty pounds, annual expenditure nineteen six, result happiness. Annual income twenty pounds, annual expenditure twenty pound ought and six, result misery.

This worked for us, and we never bothered doing it again; didn’t see the need … now, tell me about your experiences with Budgets (or No Budgets) 🙂

Pingback: The ‘No Budget Budget’ «

This is a cool article! Actually I did it since 1998 for my father because he wanted to educate me on money managment…and of course even to control me 🙂 Then I wrote it down for me in the last 3 years until dec 2008 on an excel sheet with annual graphics (if you want I can send you a picture) and I found it very useful to see where the money go, which is the major fild of expenses, if I gave to me too many bonus…and remind me where I wasted my money when I needed.

I think all readers of this blog can understand the meaning of this method, but is the first time (exept my father) I heard about that, every person who knew I did it were always make fun of me…Now I know I wasn’t alone!

Thanks Adrian 😉

I did a similar thing to this last year, except I got a whole bunch of envelopes and wrote different things on them (e.g. food, transportation, entertainment, etc.) and tracked it for about two months.

My result that I found the expense I wanted to cut back the most was medical bills (I had a lot of sporting/training injuries last year that required physiotherapy), though I had to let all that largely run its course.

There were other areas I could cut back a little, but I was (and still am) living fairly leanly, so I was happy.

My next step will be to allocate certain amounts to each envelope each month and try to stick to each amount. Now, I just need to get my fiancee on board with the project and stop springing last minute things on me.

I’m generally fairly aware on a daily basis of how much money I’m spending. What I try to do is take the cash from my two side jobs (which I’m working on expanding 😀 ) and use that for all of my monthly expenses except my rent (which I pay directly from my bank account). In a good month, I don’t have to take anything out of the bank. Usually, I end up having to take out a bit more. If I don’t take anything out of the bank (aside from the rent), then I save 70% of my income.

@ Cekki – If I were living in Italy, I would recommend an UNLIMITED budget for pasta, panini (con prosciutto, of course), and chianti (Reservo, of course) 😉

@ Caleb = Dump fiancee and move to Italy (see above) 😛

… thanks for your comments, guys!!

Adrian: Haha! 😛

Actually, she’s okay. She’s willing to learn and she is learning. She’s improved a lot in the time we’ve been together.

I don’t need to move to Italy. I have a bountiful supply of delicious, cheap Chinese food here in Taiwan (often cooked by my fiancee 😛 ). In some cases, it’s actually cheaper for me to eat out.

I keep budgeting simple: I run all my non-investment expenses through a single bank account. Each month I add up all the money that has gone out. So long as the amount spent is within expectations (it will vary from month to month due to some expenses like holidays, insurance payments not occuring each month), I do not spend too much time thinking about exactly what I have spent the money on. This takes less than 10 minutes each month. If I have a blow out, or the monthly expenses are trending upwards, then I will spend the time figuring out why, otherwise it is not worth the time to do a more detailed analysis.

I’m with you on the haircuts – these days, I think the seach fee is the biggest component of the cost of a haircut.

Interesting idea, I guess I don’t have much self-control because thought it might help me know where to cut back I would totally forget about it and start buying things that I don’t really need.

For me it has been better to set a plan of how much I have to spend and then hold myself accountable to that plan. Really like your idea though. It would help to see where money is being spent!

Thanks for the article. I like budgeting. I find that it actually keeps me in line and headed in the right direction,

@ Contest – LOL. I have a solution for you … keep reading to find out (at least while you’re reading you’re not spending!) 😉

With a site like Mint (mint.com), it is pretty easy to budget without budgeting. Sure it won’t correctly handing cross-month expenses yet, but it does tell you a great deal about what you are spending (and earning).

It won’t work for real estate investments (apart from the online appraisal estimate), but it does a fine job of tracking expenses. I used to waste time entering stuff into Quicken, and now I can spent that financial energy working the numbers on a potential real estate investment, or sorting out the costs of a new start-up I’m considering.

Neil (who, unlike his brother, finds his hair growing too quickly all too often)

Pingback: Where Did All the Money Go? «

Pingback: How the (not quite as) poor (as other) people make budgets … « How to Make 7 Million in 7 Years™

Pingback: Making Money 201? «

Pingback: How to do a personal budget …- 7million7years