… heck, you can blog, write eBooks, create a course and sell it. Anything!

If you are interested in starting your own online biz, though, I want you to visit Erica’s site … she’s been there done that when it comes to online businesses. She sold just one of her online businesses for $1.1 million and now travels the lecture circuit talking about what she learned about life and business.

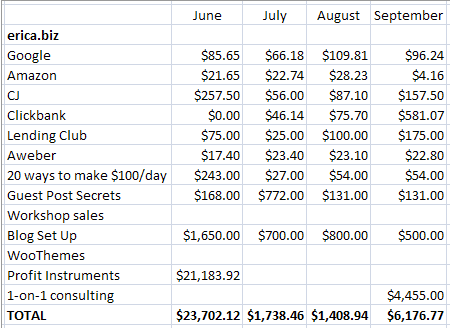

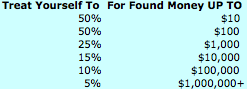

But, don’t believe the hype: you can’t “make millions” with the latest online hooey; Erica REALLY pumps her online ‘presence’ – by blogging, writing, speaking, and creating online products left, right and center – yet here are her income figures:

Ignoring one or two big sales; it’s not enough to change the world is it? Now, with Erica’s commitment and energy, she will keep building this ‘business’.

But, this is NOT how Erica made her first million, either.

Here’s what you should know: in the world of online biz, there’s a slow-path and a fast-path … a ‘real’ online business and an online ‘job’. Which one do I want you to try?

Perhaps surprisingly, I want you ALL to try the online ‘job’!

Why?

– It’s great experience: it will teach you about marketing, online businesses, writing … and, so on

– It’s also a great source of additional income that you can use to build your investment ‘war chest’ and/or your ‘real’ business startup capital

It will also help you decide if business is for you …

Then, if business is really for you, start a ‘real’ business either online or offline: one with a brand, with customers, with trailing income … one that somebody will want to buy!

Just like Erica:

By the end of 2003, my fledgling web hosting company, Simpli Hosting, was making more than my consulting gigs. The problem was, I was spending 40+ hours a week doing web development, and maybe 5-10 hours a week on hosting. I figured I had nothing to lose. I met with all my consulting clients and arranged transitions. I would be a full-time web hosting company owner in 6 months.

[lots of problems]

Things turned around. Just four months later, on September 7, 2007, I sold my company for $1.1 million to a competitor.

See the path that Erica took?

She started a business part-time … kept her full-time job (well contracts) … eventually took the plunge and went full-time into her business (this is the really hard step!) … battled all the usual BS that business owners have to put up with … and, eventually sold the business to somebody who didn’t want to go through all of that BS again to grow their own business.

That was (part of) my path to $7 million in 7 years, too. Maybe it should be yours?